Private Equity Training Programmes

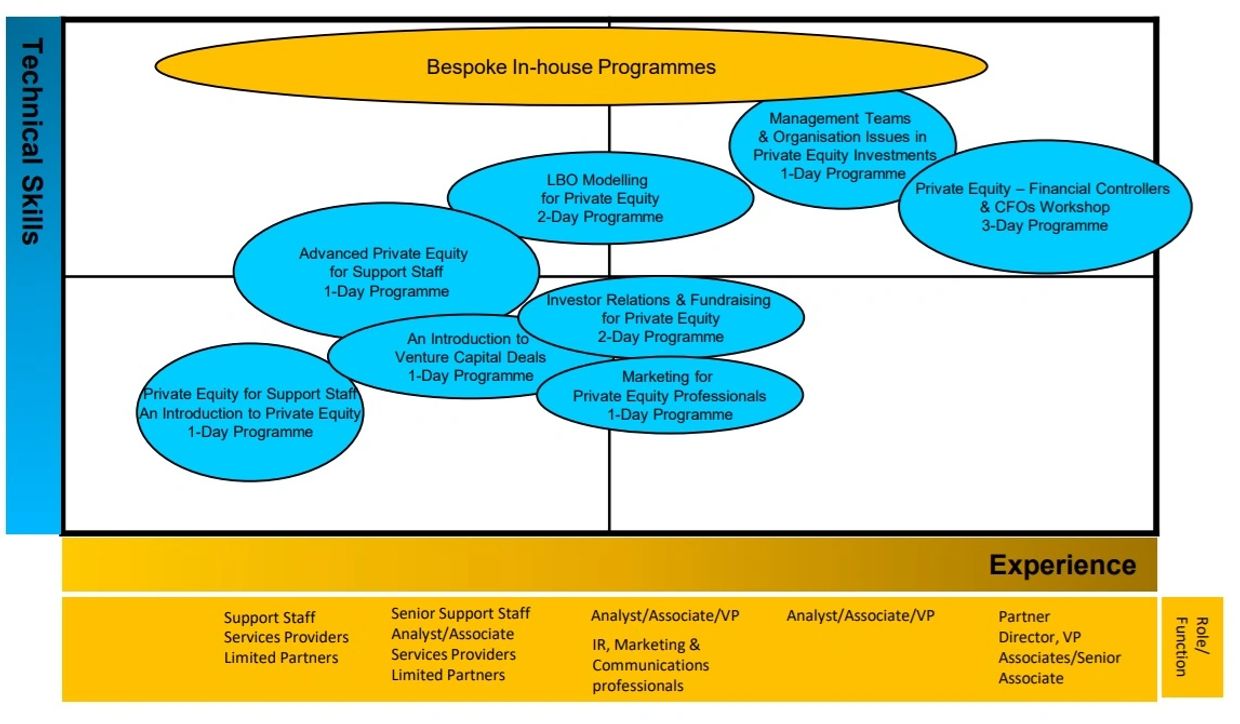

Our private equity training programmes have been developed by our faculty, specifically with practitioners in mind and are aimed at all levels. Whether you require an overview course such as Private Equity for Support Staff, or more advanced skills based courses such as Modelling, or Fundraising & Investor Relations skills, we have a specific programme for you.

With our aim to serve the training needs of the industry, we are always developing new ideas for programmes. In the event that you do not see a programme scheduled for your geographic region or if you do not find a programme for your requirements, please let us know, chances are that we may already be working on it, or we can always develop it on an in-house basis for you.

• Get Added to our Panel of Experts - We really value your thoughts and input. Want to be added to our industry panel for testing new programme ideas? Please email us at info@ascentium-associates.com

• In-house - Also, all our existing programmes and bespoke ones are available on an in-house basis, to find out more please see the in-house section.

• Current Schedule - To explore our upcoming schedule of private equity courses, please visit here

Private Equity Training - Course Overviews

Read on below to see our private equity training course overviews.

To see the full programme outlines, trainer profiles and learning outcomes please visit our downloads.

For pricing and to see the current open course schedule please visit here.

If you have any questions about the courses or want these delivered in-house, please give us a call on +442071935423 or send us a message.

Private Equity for Support Staff: 1-Day Training Course

This is a non-technical 1-day private equity training course where the key concepts of this fascinating asset class are broken down, simplified and explained in a clear way using everyday language.

This interactive course is designed to give attendees an introduction to private equity and venture capital. It is aimed at all support staff who work at a private equity or venture capital firm or service provider, and need an understanding and overview of what the industry is about. There is plenty of scope for Q&A.

At the end of the training day, attendees will have a much better understanding of the private equity landscape and where their firm fits in the picture.

An Introduction to Private Capital: 1-Day Training Course

This is a non-technical 1-day course where the key concepts of Private Capital are broken down, simplified and explained in a clear way using everyday language. This interactive course is designed to give attendees an introduction to private equity, private debt, infrastructure, natural resources and real estate. It is aimed at all support staff who work at a private capital firm or service provider, and need an understanding and overview of what the industry is about. There is plenty of scope for Q&A.

At the end of the training day, attendees will have a much better understanding of the private capital landscape and where their firm fits in the picture.

An Introduction to Private Equity & Venture Capital: 1-Day Training Course

An Introduction to Private Equity and Venture Capital is a non-technical course delivered over 6 live online training sessions (each up to 1 hour in duration and 2-3 sessions per week) where the key concepts of this fascinating asset class are broken down, simplified and explained in a clear way using everyday language.

This interactive course is designed to give attendees an introduction to private equity and venture capital. It is aimed at business professionals new to the asset class as well as all support staff who work at a private equity or venture capital firm or service provider, and need an understanding and overview of what the industry is about. There is plenty of scope for Q&A. At the end of the training programme, attendees will have a much better understanding of the private equity landscape and where their firm fits in the picture.

An Introduction to Venture Capital Deals: 1-Day Training Course

An Introduction to Venture Capital Deals is a one day interactive executive education course tailored specifically to the venture capital industry. The course covers the entire investment process from originating deals, evaluating business propositions and valuing and structuring deals, through due diligence and deal execution, the negotiation of term sheets, monitoring and adding value to exiting deals via a trade sale or IPO.

The course is highly practical, involving interactive case studies, group exercises and discussions. The course also builds on the course leader’s recent research into VC fund performance and VC investment practices in UK, Europe and USA from which a “best practice” model for VC firms and funds is postulated.

Private Equity Post Deal Organisational Learning: Custom programme

Capturing and Sharing our learning experiences for our current and future leaders.

A series of in-depth video interviews

A series of in-depth one-to-one video interviews (conducted in person or via Zoom) with colleagues involved in the deal process. The idea is to capture key learnings from a transaction that will add to the existing treasure trove of your firm’s unique learning resources, that can be used to develop your human capital, enhancing the learning of current and future employees.

Why video? Certainly, a written report is an efficient way to absorb information (and this can also be provided), however video is arguably a more powerful way of sharing our learned experiences.

The idea is to unlock the learnings from current and past deals.

This will be an invaluable learning resource for developing your human capital. Addressing key matters of your choosing, such as, what went well, what could have gone better, etc.

LBO Modelling for Private Equity: 2-Day Training Course

This 2-day private equity training course will take participants through the process of building a complete Leveraged Buy-out model (LBO) from initial valuation, sources and uses of funds, complete set of three statements to the complex debt structures to finish with overall returns and sensitivity analysis.

- Build an LBO model incorporating complex debt structures

- Model the impact of the new financing structure

- Understand the key structuring issues and debt capacity

- Complete a fully integrated LBO model

Pre-Requisites: The course requires a reasonable knowledge of accounting, basics of corporate finance, and basics of excel.

Note – This programme requires you to bring your own laptop loaded with Excel spreadsheet software

Private Equity Financial Controllers & CFOs Workshop: 3-Day Training Course

A study by McKinsey & Company (Private equity: Changing perceptions and new realities, April 2014) has illustrated that private-equity performance has been misunderstood in some essential ways. It illustrated that the private equity industry decisively outperforms public equities with respect to risk-adjusted returns, but this good news comes with a caution: top private-equity firms now seem less able to produce consistently successful funds because success has become more democratic as the general level of investing skill has increased.

The study argues that the new priority for success is differentiated capabilities. Limited partners expect funds that exploit a general partner’s distinctive strengths will do well, while more generalist approaches may fall from favour. Institutional investors will need to get better at identifying and assessing these skills, and private-equity firms will need to look inward to understand better and capitalise on the factors that truly drive their performance.

Also, some LPs have begun to “insource,” effectively doing private-equity investments on their own and recent academic research has found this approach preferable for institutional investors in certain circumstances; direct private investment saves fees and can generate better results than an external manager. However, this approach is clearly not for everyone, as it involves overcoming internal structural obstacles as well as building and maintaining investment teams with the right skills.

Whatever approach is adopted, the implications for the financial specialists in the private equity firm are clear – certain key elements in terms of making investments, such as good due diligence, particularly of the commercial issues involved, valuation related issues, managing investments to create value, and exiting investments, are critical.

The Private Equity Financial Controllers & CFOs Workshop will examine in detail these and other important aspects of the financial specialist's responsibilities. The objective is to show how the financial specialist can contribute fully to being a core advisor in key corporate strategies and decision-making

Management Teams & Organisation Issues in Private Equity Investments: 1-Day Training Course

This workshop will equip participants with a general overview and practical tools to help them understand – and deal with - the range of management and organisational issues which investors need to deal with across the life cycle of an investment. In particular, it will provide a framework for assessing managers (both in-post and candidates) and teams, as well as identifying organisational effectiveness levels and how they can be improved.

The sessions intend to show that, whilst such issues may be unfamiliar for financially-trained investors, and can appear complex, they can be approached in disciplined way that produces superior outcomes. Given the nature of the material, the course will be highly interactive.

Investor Relations & Fundraising for Private Equity: 2-Day Training Course

Investor Relations & Fundraising for Private Equity is a 2-day interactive seminar aimed at not only those who are involved in investor relations and fundraising activities but the entire team. The programme starts off with the importance of investor relations whether through a dedicated team or not and how the role has evolved over the years. Next is a focus on building and managing LP relationships.

Other modules explore ways of communicating with existing and potential investors and steps in getting ready for the next fundraise. Throughout the programme, the current concerns of IR professionals will be constantly debated.

Marketing for Private Equity Professionals: 1-Day Training Course

Marketing for Private Equity Professionals is an intensive one-day interactive executive education course tailored specifically to the private equity & venture capital sectors. It is aimed at private equity and marketing professionals who are involved with the marketing of medium-sized private equity firms and of venture capital firms.

Delegates will be given the tools, through talks, case studies and practical exercises, to develop or refine a workable marketing strategy for their own firms and to learn how to implement the strategy through an effective marketing programme.

Copyright © 2025 Ascentium Associates Limited - All Rights Reserved.